Real U.S. shortfall: $4.6 trillion in red'Taxing 100% of all wages, salaries, corporate profits would not eliminate a deficit of this magnitude'By Jerome R. Corsi World Net Daily Dec. 19, 2006 |

Popular

Mike Johnson Pushes Debunked Lie That Israeli Babies Were 'Cooked in Ovens' On October 7

'It Has to Be Stopped': Netanyahu Demands Pro-Palestine Protests at U.S. Colleges Be Shut Down

'These Protesters Belong in Jail': Gov. Abbott Cheers Arrest of Pro-Palestine Protesters at UT Austin

Claim Jewish Student Was 'Stabbed In The Eye' by Pro-Palestine Protester Draws Mockery After Video Released

'We Aren't Going Anywhere': TikTok CEO Vows to Fight TikTok Ban in Court

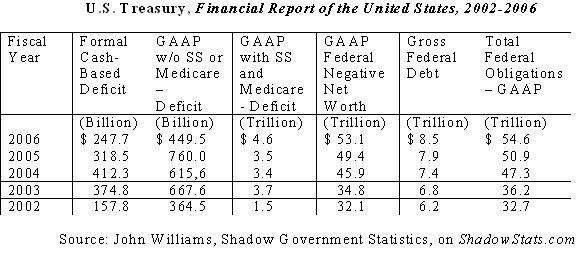

The real 2006 federal budget deficit was $4.6 trillion, not a previously reported $248.2 billion, according to the 2006 Financial Report of the United States Government as released by the Treasury Department Friday. "The 2006 federal budget deficit of $4.6 trillion is $1.1 trillion more than the 2005 federal budget deficit," econometrician John Williams, who publishes the website Shadow Government Statistics, told WND. "The Bush administration is in an untenable situation with a budget deficit this dramatic. Taxing 100 percent of all wages, salaries, and corporate profits would not eliminate a deficit of this magnitude, and cutting Social Security and Medicare spending is politically impossible." In his subscription newsletter, Williams comments that the GAAP accounting numbers reported in the 2006 Treasury report show that, "the actual deficit number was nearly 19-times the size of the gimmicked 'official' deficit for 2006 of $248 billion. Total obligations were 4.2-times annual U.S. gross domestic product (GDP)."  The difference between the $248 billion "official" budget deficit numbers and the $4.6 trillion budget deficit reported in the 2006 Financial Report of the United States Government is that the official budget deficit is calculated on a cash basis, where all tax receipts, including Social Security tax receipts, are used to pay government liabilities as they occur. The calculations in the 2006 Financial Report of the United States Government are calculated on a GAAP basis ("Generally Accepted Accounting Practices") that includes year-for-year changes in the net present value of unfunded liabilities in social insurance programs such as Social Security and Medicare. Under cash accounting, the government makes no provision for future Social Security and Medicare benefits in the year in which those benefits accrue. "Truthfully," Williams points out, "there is no Social Security 'lock-box.' There are no funds held in reserve today for Social Security and Medicare obligations that are earned each year. It's only a matter of time until the public realizes that the government is truly bankrupt and no taxes are being held in reserve to pay in the future the Social Security and Medicare benefits taxpayers are earning today." Calculations from the 2006 Financial Report of the United States Government also show that the GAAP negative net worth of the federal government has increased to $53.1 trillion, while the total federal obligations under GAAP accounting now total $54.6 trillion. "The Treasury is right in that Social Security and Medicare must be shown as liabilities on the federal balance sheet in the year they accrue," Williams argues. "To do otherwise is irresponsible, nothing more than an attempt to hide the painful truth from the American public. The public has a right to know just how bad off the federal government budget deficit situation really is, especially since the situation is rapidly spinning out of control." "The federal government is bankrupt," Williams explained to WND. "In a post-Enron world, if the federal government were a corporation such as General Motors, the president and senior Treasury officers would be in federal penitentiary." In a letter included in the 2006 Financial Report of the United States Government, David M. Walker, the comptroller general of the United States, commented on the $53 trillion federal government GAAP accounted negative net worth by noting, "This translates to a current burden of about $170,000 per American or approximately $440,000 per American household." Remarkably, the U.S. Government Accountability Office refused to certify or render an opinion on the consolidated financial statements contained in the 2006 Financial Report of the United States Government, noting serious financial management problems at the Department of Defense, the federal government's inability to adequately account for and reconcile intragovernmental activity and balances between federal agencies, and the federal government's ineffective process for preparing the consolidated financial statements. In his letter, David Walker commented that until these financial reporting problems were resolved within the federal government, the problems outlined in the audit report "will continue to have adverse implications for the federal government and American taxpayers." "That's an understatement," Williams told WND. "What the comptroller of the United States is telling us is that as bad as a $4.6 trillion federal budget deficit and a $53.1 trillion GAAP negative net worth are today, the situation with the Bush administration federal budget deficit might even be worse yet if the government’s overall bad accounting procedures could be fixed. With truly accurate GAAP reporting by the various administrative agencies, the 2006 financial report of the federal government would have shown even larger deficits and a larger negative net worth, hard as that may be to imagine." |