The Subprime Auto Loan Meltdown Is HereBy Michael SnyderThe Economic Collapse Feb. 25, 2016 |

Popular

Report: Hamas Says Witkoff Promised to Lift Gaza Blockade in Exchange for Edan Alexander

Ben Shapiro, Mark Levin and Laura Loomer Warn of Foreign Influence... From Qatar

Eloy Adrian Camarillo, 17, Arrested in Shooting Death of Infowars Reporter Jamie White

NYT: Trump Ended War With Houthis After They Shot Down U.S. Drones, Nearly Hit Fighter Jets

'If Iran Abandons Its Nuclear Program, Will Israel Do The Same?': Israeli Spox Launches Into Tirade Over Pointed Question

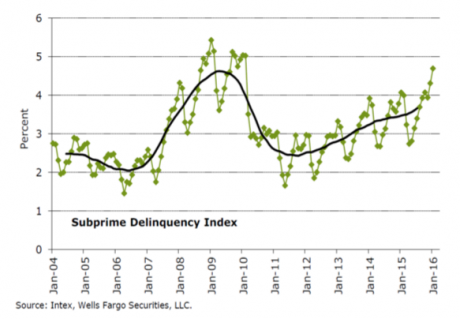

Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this "mini-boom" was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been "repackaged" and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price. Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this "mini-boom" was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been "repackaged" and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price.Everything would be fine if the number of subprime borrowers not making their payments was extremely low. And that was true for a while, but now delinquency rates and default rates are rising to levels that we haven't seen since the last recession. The following comes from Time Magazine… People, especially those with shaky credit, are having a tougher time than usual making their car payments.The chart below was posted by David Stockman, and it shows how the delinquency rate for subprime borrowers has hit the highest level since 2009. In fact, we are not too far away from totally smashing through the previous highs that were set during the last crisis…  It is quite foolish to try to sell expensive cars to people with bad credit. This is especially true now that the economy is slowing down significantly in many areas. But people are greedy and they are going to do what they are going to do. The most disturbing thing to me is that many of these loans are being "repackaged" and sold off to investors as "solid investments". The following description of what has been happening comes from Wolf Richter… The business of "repackaging" these loans, including subprime and deep-subprime loans, into asset backed securities has also been booming. These ABS are structured with different tranches, so that the highest tranches -- the last ones to absorb any losses -- can be stamped with high credit ratings and offloaded to bond mutual funds designed for retail investors.It almost makes you want to tear your hair out. This is exactly the kind of thing that caused so much chaos with subprime mortgages. When will we ever learn? Meanwhile, we continue to get even more numbers that indicate that a substantial economic slowdown has already begun… We just got the clearest sign yet that something is wrong with the US economy.Statistic after statistic is telling us that a new recession is already here. And of course some would argue that the last recession never actually ended. According to John Williams of shadowstats.com, the U.S. economy has continually been in contraction mode since 2005. If we do not learn from history, we are doomed to repeat it. All over the world, "non-performing loans" are starting to become a major problem, and already some financial institutions are starting to get tighter with credit. As credit conditions tighten up, this is going to cause economic activity to slow down even more. And as economic activity slows down, it is going to become even harder for ordinary people to make their debt payments. Deflationary forces are on the rise, and most global central banks are just about out of ammunition at this point. Everyone knew that the global debt bubble could not keep expanding much faster than the overall rate of economic growth forever. It was only a matter of time until the bubble burst. Now we can see signs of crisis popping up all around us, and things are only going to get worse in the months ahead… |