Obama's fiscal fantasylandOnly true Keynesians still think we can spend our way to prosperityBy Richard W. Rahn, Washington Times Jul. 01, 2010 |

Popular

Sen. Hawley: Send National Guard to Crush Pro-Palestine Protests Like 'Eisenhower Sent the 101st to Little Rock'

Mistrial Declared in Case of Arizona Rancher Accused of Killing Migrant Trespasser

AP: 'Israeli Strikes on Gaza City of Rafah Kill 22, Mostly Children, as U.S. Advances Aid Package'

John Podhoretz Demands National Guard Be Sent Into Columbia U to Put Down Pro-Palestine Protests

House Passes $95B Foreign Aid Giveaway to Israel, Ukraine and Taiwan, Combined With TikTok Ban

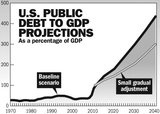

"Irresponsible" refers to Congress and the Obama administration - and here's why. For thousands of years, businesses, organizations, governments and even individuals have relied on a basic tool to make sure they do not spend or borrow more than they can service - it is called a budget. Yet, for the first time since 1974, when the current rules were put into effect, the U.S. House of Representatives does not intend to pass a budget resolution. The main purpose of the budget resolution is to set discretionary spending caps for the coming fiscal year. "Irresponsible" refers to Congress and the Obama administration - and here's why. For thousands of years, businesses, organizations, governments and even individuals have relied on a basic tool to make sure they do not spend or borrow more than they can service - it is called a budget. Yet, for the first time since 1974, when the current rules were put into effect, the U.S. House of Representatives does not intend to pass a budget resolution. The main purpose of the budget resolution is to set discretionary spending caps for the coming fiscal year.Without a budget resolution, members of Congress are, in essence, able to spend as much money as they wish, subject only to the limitation of getting half plus one of the other members to go along with the spending proposal. The budget procedure was put in place to make sure members of Congress would not spend money as irresponsibly as many teenagers might if they were given unlimited credit cards. If teenagers were in charge of the federal budget, we might end up with a $1.5 trillion deficit this year. Ah, but we are going to have a $1.5 trillion deficit this year - and who's in charge? In the face of the unprecedented congressional spending binge, President Obama has been asking Congress to spend even more. Not content with actively promoting the eventual bankruptcy of the United States, Mr. Obama is urging foreign leaders also to increase their government spending - which is truly bizarre. Look at the facts. All of the major European countries have been increasing government spending and deficits at unsustainable rates. The talk for the past couple of months has been about which countries would follow Greece in going over the financial cliff. Responsible economists, financial leaders and, most important, the markets have been telling European leaders they must cut government spending. Over the past couple of weeks, a number of those leaders have responsibly and courageously come forth with real spending-reduction programs. Britain's new government, despite being a coalition government, has proposed a 25 percent cut in most government departments. Can you imagine the howls from Congress and the U.S. news media if a U.S. president proposed even a 5 percent cut, though a far larger one is needed? Mr. Obama increasingly appears to be living in a fiscal fantasyland. In his letter to the Group of 20 on June 18, the president wrote: "My administration will cut the budget deficit we inherited in half by FY 2013 and work to reduce our fiscal deficit to 3 percent of [gross domestic product] by FY 2015...." The president already has put forward two budgets, including projections for the next decade, but they contain no specifics for reaching such a goal. Without laying out which programs he proposes to reduce, the words are nothing more than hollow rhetoric. (Please see accompanying graph.) The president still seems to believe in the imaginary world of spending multipliers - whereby each dollar of additional spending results in something in the order of $1.40 in additional output. Proponents of such ideas normally refer to themselves as Keynesians (followers of the ideas of John Maynard Keynes, 1883-1946). A careful reading of Keynes will show that his prescriptive "spending stimulus" ideas were much more limited than what many of his followers now advocate. The Keynesians and socialists have run hundreds of experiments around the world for the past 70 years, inducing governments to try to spend themselves into prosperity. It doesn't work. In the 1970s, Keynesian prescriptions led to "stagflation" in the U.S. and many other countries. It was only when Ronald Reagan, Margaret Thatcher and eventually many other leaders (using the ideas of F.A. Hayek and Milton Friedman) reversed course by cutting tax rates and curtailing spending growth that their economies began to grow rapidly without inflation. Mr. Obama seems to have never learned these lessons, and some of his advisers, who once understood what works and what doesn't, seem to have forgotten. By nature, people like to spend other people's money, and too many in Congress loved what was billed as Keynesian economic theory because it gave them a rationale to be irresponsible spenders. If you are confused about whom to believe, just think for a minute. If increasing government spending really could lead to increased prosperity, why limit government spending at all? From your own observations, do governments spend your money as wisely as you do? And do government workers on average work harder, and are they more productive than workers you observe in the private sector? Finally, where does government get all of that extra money to spend? If it's from taxes, does that not mean taxpayers will have less incentive to work, save and invest? If it is from borrowing more money, does that not mean everyone will have to pay more taxes in the future and hence will be worse off? And, if the government just prints the additional money, won't it be worth less, and won't workers and savers be worse off? Responsible people, whether they are national leaders or average citizens, understand that both in their personal and public lives they cannot spend themselves into prosperity. ____ Richard W. Rahn is a senior fellow at the Cato Institute and chairman of the Institute for Global Economic Growth. © Copyright 2010 The Washington Times, LLC. |