Citizen-Based Taxation: Thank War for Itby Wendy McElroyThe Dollar Vigilante Jan. 15, 2013 |

Popular

Claim Jewish Student Was 'Stabbed In The Eye' by Pro-Palestine Protester Draws Mockery After Video Released

Mistrial Declared in Case of Arizona Rancher Accused of Killing Migrant Trespasser

Sen. Hawley: Send National Guard to Crush Pro-Palestine Protests Like 'Eisenhower Sent the 101st to Little Rock'

Senate Passes $95B Giveaway to Israel, Ukraine, and Taiwan, Combined With TikTok Ban

AP: 'Israeli Strikes on Gaza City of Rafah Kill 22, Mostly Children, as U.S. Advances Aid Package'

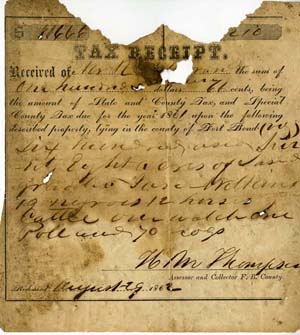

Only two nations in the world have citizenship-based taxation: the United States and Eritrea in northeastern Africa. Only two nations in the world have citizenship-based taxation: the United States and Eritrea in northeastern Africa.Citizenship-based taxation means that the payment of taxes is determined by citizenship rather than residency or the source of income. In other words, the foreign income earned by an American abroad is taxed by the Internal Revenue Service even though it is also assessed by the nation in which he lives. An American businessman living in Hong Kong is legally required to render unto two Caesars even if he receives 'benefits' from only one. This amounts to a stiff financial and paperwork penalty on Americans who dare to depart their native soil. Eritrea imposes a 2% tax on citizens who live abroad. It has come under intense criticism not only for the “diaspora tax” but also for its aggressive pursuit of collection. The Toronto Star (July 24, 2012) reported, “In 2011, governments in both the United Kingdom and Germany demanded that Eritrea stop collecting diasporic taxes on the grounds that the practice might contravene the Vienna Convention on Diplomatic Relations. Though pressure to outlaw the tax is mounting elsewhere around the world, the Canadian government has yet to act.” Increasingly, the tax is being called a human rights issue. America imposes higher penalties and is more vicious in its collections. Nevertheless, the American Goliath has largely escaped criticism. Without approving any other form of taxation, a particularly bright light should be shone on the citizenship-based version. For one thing, it is rooted in war. Specifically, citizenship-based taxation dates back to the American Civil War (1861-1865). In 1861, Congress passed the first personal income tax in order to finance the Civil War expenses of the North. The Revenue Act of August 5th, 1861 set a flat rate of 3% on individual incomes over $800. The tax applied “to every person residing in the United States” but it was not collected; the Act had been slapped together in a rushed manner and it carelessly contained no enforcement mechanism. Instead, the income tax provision was quickly repealed and replaced by the Revenue Act of 1862. This Act provided for a progressive tax of 3% on annual incomes above $600 and 5% on incomes above $10,000. Collection was facilitated by creating the Bureau of Internal Revenue – a forerunner to the Internal Revenue Service. The Act also established a special category of taxation at 5% for domestic income earned by a “citizen of the United States residing abroad.” Expatriates were included for a specific reason. 1862 also saw an extensive push to draft men into the Northern army. There were ways to avoid military services, such as hiring someone to take your place, but a popular method was to “skedaddle.” Skedaddling became so commonplace that a popular settlement place in New Brunswick was renamed Skedaddle Ridge because of the presence of so many draft dodgers from Maine. One of the purposes of the higher tax on Americans abroad was to discourage men from fleeing military duty or, at least, to penalize them for doing so. In 1864, a new Revenue Act raised the overall rates and created a third tax bracket. It also imposed an assessment on "any citizen of the United States residing abroad, whether derived from any kind of property, rents, interest, dividends, or salaries, or from any profession, trade, employment, or vocation, carried on in the United States or elsewhere, or from any other source whatever.” [Emphasis added.] A citizenship-based double tax was now reality. It was justified on the grounds that the honor and benefits of citizenship followed wherever an American might venture. No Americans renounced their citizenship over the double taxation. There was a simple reason for this. From its creation, America implicitly adopted the common law tradition of perpetual allegiance by which renunciation was not an option. This was high irony since America had been founded by people who violently expatriated themselves from Britain. Moreover the Declaration of Independence reads like a proclamation of expatriation. It opens, “When, in the course of human events, it becomes necessary for one people to dissolve the political bands which have connected them with another...a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.” But not until 1868 did Congress pass an Expatriation Act that stated, "the right of expatriation is a natural and inherent right of all people....[A]ny declaration, instruction, opinion, order, or decision of any officers of this government which restricts, impairs, or questions the right of expatriation, is hereby declared inconsistent with the fundamental principles of this government." Congress did not act to vindicate Americans who lived abroad. Rather it wished to ensure that immigrants were not vulnerable to allegiance demanded by their lands of birth. For example, both France and Germany were prone to conscripting naturalized Americans when they went home to visit. The Civil War income tax measures were repealed in 1872. Then, in 1894, Congress introduced the first peacetime federal income tax which also applied to Americans living abroad; the rate was 2% for incomes over $4,000. This tax was short-lived, however. The next year, the Supreme Court ruled in Pollock vs. Farmers' Loan & Trust Co. that it was unconstitutional for reasons not related to double taxation. Then, a dramatic change in taxation occurred in 1913 with the ratification of the 16th Amendment to the Constitution which stated, “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived...” The Amendment de facto overturned Pollock. It was the beginning of the modern federal tax system. And, again, it applied to all American citizens at home or abroad. A March 6, 1914 headline in the New York Times announced, “To Become British: 2 Seligmans and Others May Change Citizenship Owing to Income Impost. Called Double Taxation.” The article discussed “the sudden popularity of British citizenship with American residents of London,” noting that the renunciations and threats seemed to aim at pressuring the US to suspend the taxation of Americans abroad. The pressure was not successful. Over its history, the US government has made token changes in citizenship-based taxation; for example, in 1918, a foreign tax credit was introduced to offset the competitive disadvantages of American corporations who operated abroad. Here, too, the policy was driven by war. The credit was necessary due to the precipitous rise in all taxes caused by World War I. But the fundamental structure of double taxation has not been questioned by anyone but its victims. Citizenship-based taxation is simply too lucrative for the government to reconsider. As long as the government can paint Americans who live abroad as tax evaders, dodgers or somehow unpatriotic, then there will be little public sympathy. Government will be able to raise more money for the periodic slaughters called war as well as for the other public 'services' it performs. Further Reading: _ Wendy McElroy is a renowned individualist anarchist and individualist feminist. She was a co-founder along with Carl Watner and George H. Smith of The Voluntaryist in 1982, and is the author/editor of twelve books, the latest of which is "The Art of Being Free". Follow her work at http://www.wendymcelroy.com. |